Reconciliation

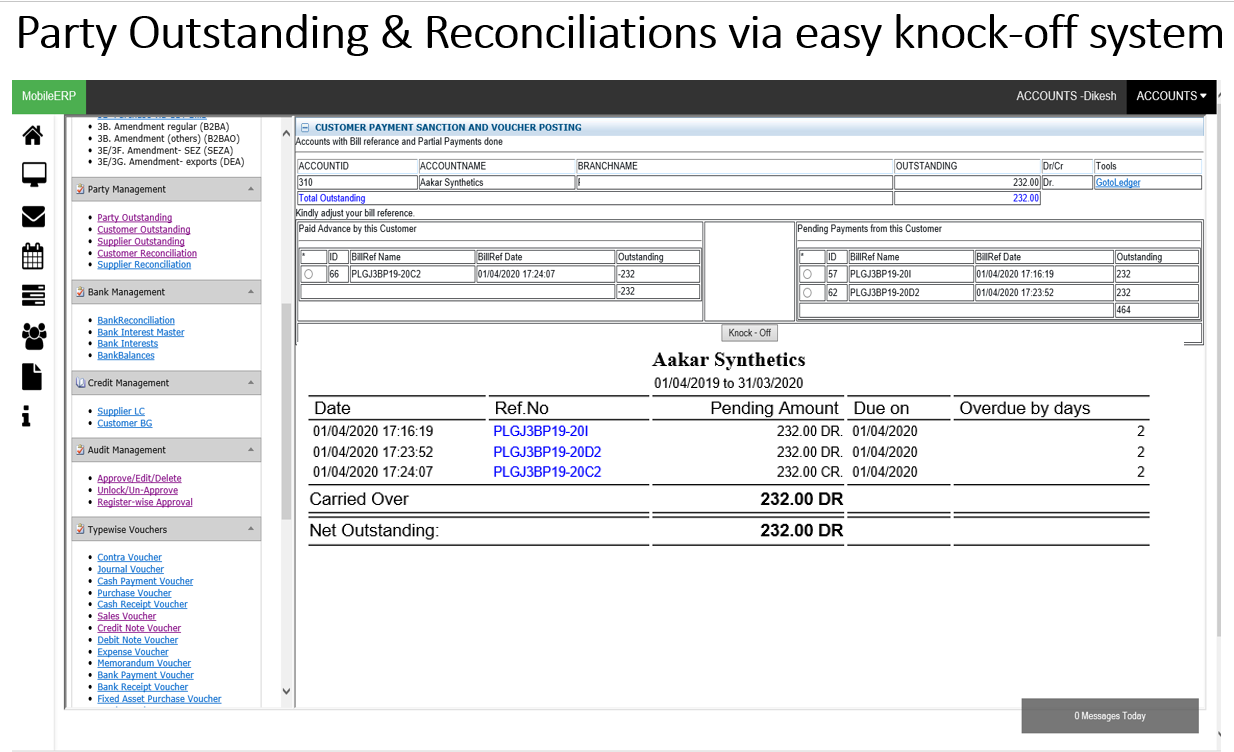

Customer reconciliation

Supplier reconciliation

Intercompany reconciliation

Auto Bank reconciliation

Closing Entries

Automatic corrections

JV Entry Capabilities

Intercompany settlements

Lock and Close Ledgers

Compliance Audit

Ensure Transaction matching

Ensure Tax Compliance done

Mass transaction screening

Variance analysis and reporting

Closing Process

Create New Year

Trial Balance Matching

Transfer Account Balance

Check TB of New Year

What is Accounts Reconciliation?.

Reconciliation is an accounting process that compares two sets of records to check that figures are correct and in agreement. ... Account reconciliation is particularly useful for explaining the difference between two financial records or account balances. e.g. Comparing Bank Statement from ABC Bank with Bank Book GL entries in system.There are five main types of reconciliation accounting that are used in day-to-day business:

1. Bank reconciliation.

2. Customer reconciliation.

3. Vendor reconciliation.

4. Inter-company reconciliation.

5. Business-specific reconciliation.

What Are the Steps in Account Reconciliation?

Accountants go through each account in the general ledger of accounts and verify that the balance listed is correct and accurate.

This involves comparing the general ledger account balance with other independent sources of this data, such as bank and credit card statements.

What is Auto Bank Reconciliation?.

The Auto Bank Reconciliation option enables you to upload an electronic version of a bank statement (provided by the bank) and ‘automatically’ reconcile it to your system bank using ‘matching’ rules applied by the system.Where the system cannot ‘match’ transactions, it will suggest several possible matches or allow you to create and post a matching transaction.

This is a great way of reducing the manual effort in reconciling your system bank accounts with your bank statements and improving accuracy.

You can quickly identify unreconciled items and complete reconciliations when you need to - daily, weekly or monthly.

In this case you have to upload Bank statement provided by bank in XLS, JSON OR XML into MobileERP system and run Auto Bank Reconciliation Process.

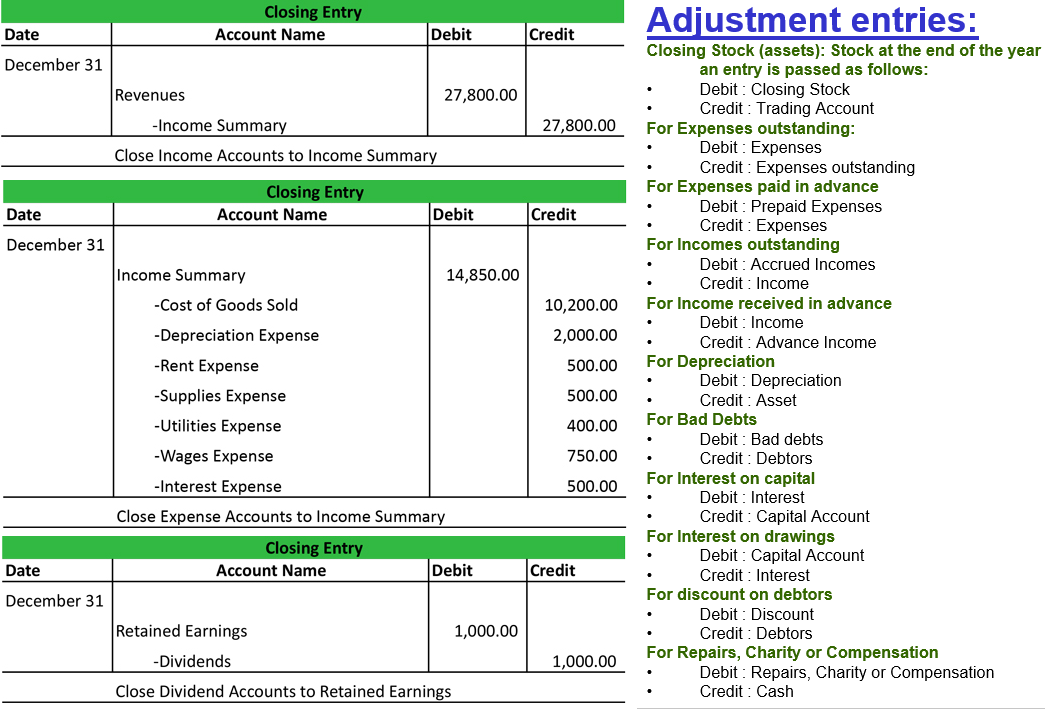

What is Closing Entry?

A closing entry is a journal entry made at the end of the accounting period. It involves shifting data from temporary accounts on the income statement to permanent accounts on the balance sheet. All income statement balances are eventually transferred to retained earnings.There are 10 closing entries to be made at end of year?

The sequence of the closing process is as follows:

1. Post the Stock Value if Periodic Accounting method is used.

2. Post the Foreign Exchange Gain/Loss Entry.

3. Do Reversing entries which are optional accounting procedures which may sometimes prove useful in simplifying record keeping. A reversing entry is a journal entry to “undo” an adjusting entry.

4. Do Adjusting entry. There are four types of accounts that will need to be adjusted. They are accrued revenues, accrued expenses, deferred revenues and deferred expenses. Accrued revenues are money earned in one accounting period but not received until another.

5. Do Bad Debts entry. Bad debt is an expense that a business incurs once the repayment of credit previously extended to a customer is estimated to be uncollectible. Bad debt is a contingency that must be accounted for by all businesses who extend credit to customers, as there is always a risk that payment will not be received. 6. Do Asset Depriciation entry. 7. Close the revenue accounts to Income Summary/P&L A/C.

8. Close the expense accounts to Income Summary/P&L A/C..

9. Close Income Summary/P&L A/C. to Retained Earnings.

10. Close Dividends to Retained Earnings.

Note:

1. Deferred revenue is the portion of a company's revenue that has not been earned, but cash has been collected from customers in the form of prepayment.

2. Deferred expenses are expenses a company has prepaid. They are recorded as “Assets” on a balance sheet. Common examples of deferred expenditures include: Startup costs. Advertising fees. Advance payment of insurance coverage. An intangible asset cost that is deferred due to amortisation.

3. Accrued expenses are the expenses of a company that have been incurred but not yet paid.

4. Accrued revenue is revenue that has been earned by providing a good or service, but for which no cash has been received. Accrued revenues are recorded as receivables on the balance sheet to reflect the amount of money that customers owe the business for the goods or services they purchased.

What is Compliance Audit?

A compliance audit is an independent evaluation to ensure that an organization is following external laws, rules, and regulations or internal guidelines, such as corporate bylaws, controls, and policies and procedures. ... Boards of directors are also often accountable for operations and need to see audit reports. Compliance is often involved in strategic discussions about where the business is going and what it needs to achieve its objectives in a compliant way. While audit takes those objectives and looks back to see if they were achieved in the way they were meant to be.How audit cases are generated?

Audit policies are used to identify expense reports, purchase orders, and vendor invoices that don't comply with business rules that you define and configure as audit policy rules. Audit policies are run in batch mode. When you run an audit policy, all the policy rules that are part of that policy are run at the same time.Each policy rule evaluates a set of documents. The policy rule selects documents that are in the document selection date range and that match the specified criteria. For example, one policy rule might select expense reports that have meals that exceed 50.00. Another policy rule might select vendor invoices that are payable to a specific vendor. For each document that is selected in the set, a violation is generated. That violation is a record that a particular document, such as invoice 12345, doesn't comply with the policy rule. Multiple audit violation records are grouped together and associated with audit cases. By default, cases for each audit policy are grouped by audit policy rule. If you prefer, you can select other grouping criteria by using the Case grouping criteria page. For example, you can group expense headers by project ID and vendor invoices by vendor account. In this case, all expense header violations that have the same project ID will be grouped in the same case, and all vendor invoices that have the same vendor account will be grouped in the same case.

What are different Types of Audit Policy Rules?

1. Conditional: Evaluate source document attributes against specified values.

2. Aggregate: Evaluate multiple source documents or source document lines against a policy rule by aggregating numeric values.

3. Sampling: Randomly select a specified percentage of the source documents to evaluate for policy violations.

4. Duplicate: Evaluate source documents to determine whether they contain duplicate entries in specified fields.

5. List search: Evaluate source documents for specific entities.

6. Keyword search: Evaluate source documents to determine whether they contain certain words.

Why proper Financial Closing is required?.

Corporate or group reporting has been subject to incessant change since the introduction of the Sarbanes Oxley Act in 2002. No major jurisdiction has been exempt from the work of the legislators applying increased controls and requirements on the way and the content that businesses report to their stakeholders. Furthermore, this does not just relate to financial results but has been extended to the reporting of non financial and sustainability information, and has recently added Carbon Emission Reporting which in itself has significant financial implications. In addition to these regulatory requirements is the continual challenge to streamline the entire financial close process and reduce both the effort and time it takes to complete. If organizations are to deliver the fast and accurate financial close required by stakeholders and regulatory bodies they need to be able to control and improve the entire ‘extended’ financial close process. While doing this, organizations also need to adhere to good governance practices and be transparent. Leading organizations recognize that the ‘close’ begins with sub ledgers and ends with the delivery of statutory filings and therefore are adopting integrated financial close solutions that address this entire process. In fact, they are going further by integrating with their Governance, Risk and Compliance (GRC) solutions to ensure the finance department is not just fast but applies governance and is fully transparent along the way. This helps organizations create a finely tuned and well oiled process that delivers a truly world class financial close.

What is year end closing process?.

At the end of a fiscal year, you must run the year-end close process to transfer opening balances to the new year. Most organizations will run the year-end close process multiple times. The first time would be to get the balances moved into the new fiscal year. The year-end close can then be run again, as many times are required, to move the balances from adjusting entries into the new fiscal year. During the year-end close process, there are two types of possible transactions created. An Opening transaction is always generated and is used to create the opening balances in the new fiscal year. The Opening transaction shows the balance sheet ledger account balances in the new fiscal year and balances from the profit and loss ledger account balances in the retained earnings ledger account in the new fiscal year. The Closing transaction is optionally created to bring the balances of the profit and loss accounts down to zero in the fiscal year being closed.Lock the general ledger at period end before year end closing process.

In General ledger, you can complete closing procedures for a period or a year. Closing processes prepare the system for a new period. To prepare the system for a new year, you must run the year end close process. Each organization has different processes and steps that it performs for the end of a period. Here are some optional steps for period ends: Complete all the tasks for all other modules, such as Accounts receivable, Accounts payable, and Inventory.1. Verify that all journals are posted.

2. Run foreign currency revaluation to generate any unrealized gain or loss amounts.

3. Settle transactions for each ledger account.

4. Process any required allocations.

5. Manually post period-end adjustments via JV.

6. Journalize transactions, and review the Ledger journal report.

7. Perform a consolidation by using a consolidation company or Financial reporting.

8. Generate period-end financial statements by using Financial reporting.

9. Set ledger periods to On Lock, so that no further posting occurs.