What is the new GST return filing system?

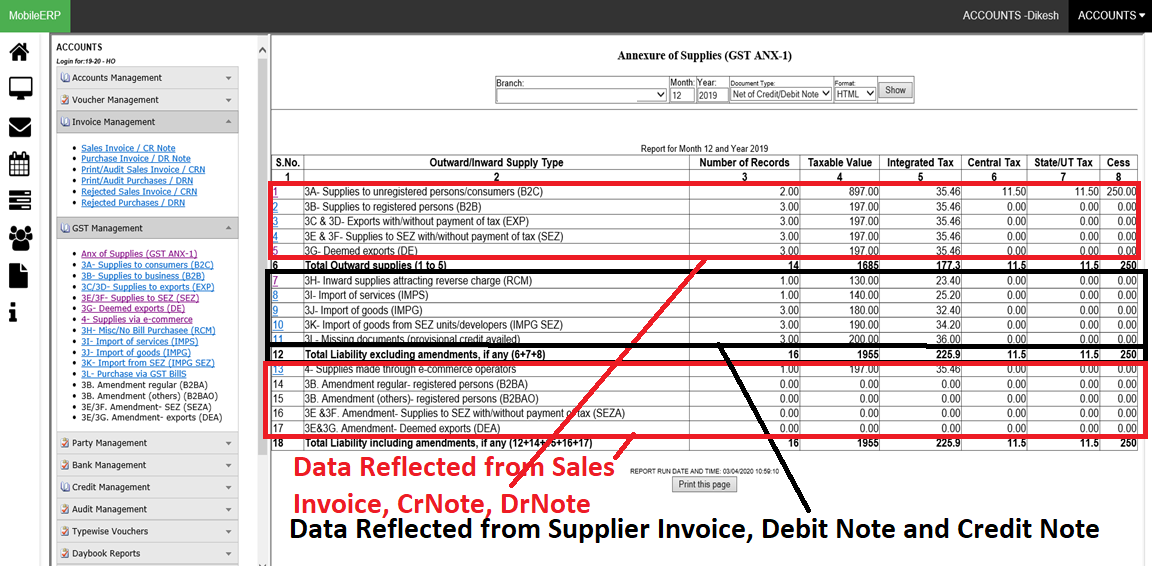

Under the new return system, decided to be implemented from 1st April 2020, the proposed main return called FORM GST RET-1 will contain details of all outward supplies, availed input tax credit, and payment of taxes, along with interest and late fees, if any. This return form will have two annexures, namely, FORM GST ANX-1 (Annexure of Outward Supplies) and FORM GST ANX-2 (Annexure of Inward Supplies).FORM GST ANX-1 will contain the details of all outward supplies, inward supplies that are liable to reverse charge, and import of goods and services, that needs to be reported invoice-wise (except for B2C supplies) in real-time. On the other hand, FORM GST ANX-2 will contain the details of all inward supplies and will allow the recipient of supplies to take action on the auto-drafted documents uploaded by the supplier, available on a real-time basis.

What is FORM GST ANX-1?

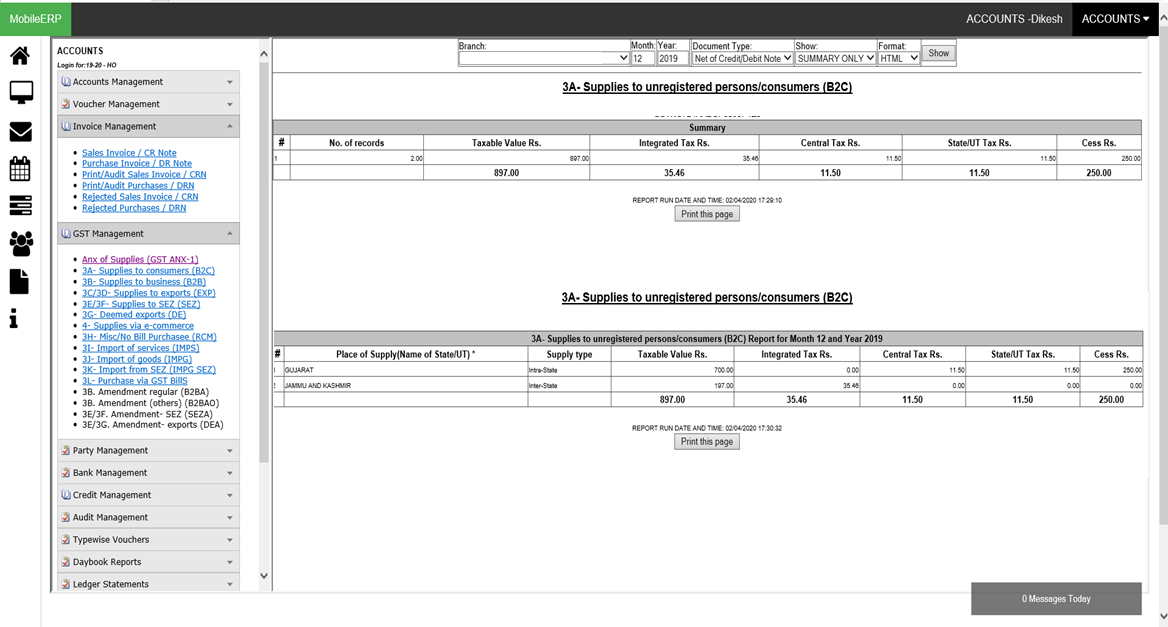

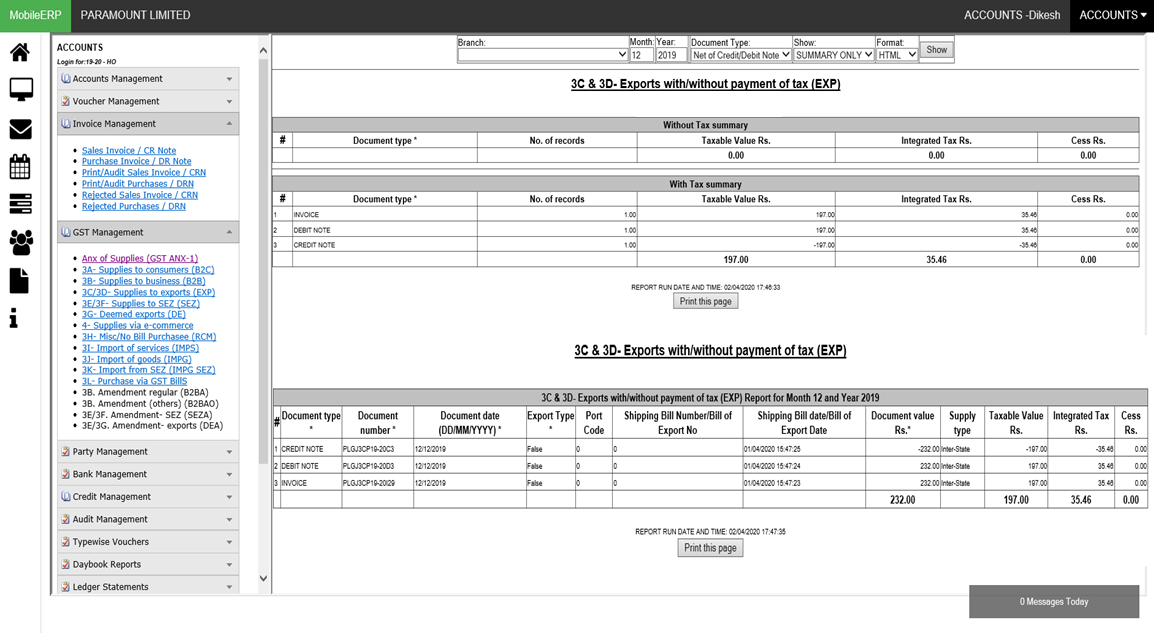

Form GST ANX-1 is an annexure filed along with GST RET-1/2/3 under the new GST return system. This annexure will contain details pertaining to all outward supplies, inward supplies attracting reverse charge, and import of goods or services. The taxpayers can report invoice-wise details in this annexure upon the availability of continuous invoice uploading facility on the GST portal.Furthermore, the invoices in GST ANX-1 can be uploaded by the supplier on a real-time basis and can be viewed simultaneously by the recipient of supplies in their FORM GST ANX-2 to take the desired action.

What is FORM GST ANX-2?

Form GST ANX-2 is an annexure to the GST RET-1/2/3. It is an auto-drafted return form containing the details of inward supplies, available for the recipient of supplies to take necessary action, i.e. accept, reject or mark the documents as pending. If the recipient accepts these documents, it would mean that the supplies reported in Form GST ANX-1 are correct.The recipient can take three actions in GST ANX-2: accept, reject, or mark as pending. If no action is taken for any particular transaction, it will be considered Accepted by default.

General FAQs on New GST Return

To help you easily understand the new GST return filing system, here are the answers to all the frequently asked questions about the terms and concepts related to New GST returns –RET-1, ANX-1, ANX-2, RET-2 (Sahaj), and RET-3 (Sugam).Q.1 Can the taxpayer change the return filing period from quarterly to monthly or vice versa?

Under the new return system, the taxpayer would be able to change the periodicity of return (RET-1 Normal return) filing (quarterly to monthly or vice versa) only once – before the filing of the first return of that financial year.

Q.2 What are the types of regular returns available for a taxpayer who chooses to file his returns quarterly?

Taxpayers having aggregate turnover of up to ₹ 5 Crore in the preceding financial year can choose to file either Form GST RET-1 (Normal Quarterly), Form GST RET-2 (Sahaj), or Form GST RET-3 (Sugam).

Q.3 What actions can be taken by the recipient with regards to the auto-populated documents uploaded by the supplier?

A supplier can upload invoice details by 10th of the subsequent month (in case of monthly filing) or 10th of the month following the quarter (in case of quarterly filing) which gets auto-populated in Form GST ANX-2 on a real-time basis. Thus, the recipient can either accept or reset/unlock a document up to the 10th of the next month (following the month in which the documents have been uploaded). After this date, the recipient can either accept, reject or keep the auto-populated document as pending.

Q.4 When will the supplier be intimated that the recipient has rejected the document uploaded by him?

Once the recipient files his return, the supplier will get intimation regarding the documents rejected by the recipient. Moreover, the status of a document such as ‘Accepted’, ‘Rejected’ and ‘Pending’ shall be reflected in Form GST ANX-2.

Q.5 I have uploaded all the document details correctly but have entered them in the wrong table in form ANX-1. Is there any quick solution available?

Once the recipient rejects such documents, instead of making changes to each document, a facility to shift all the documents to the appropriate table will be provided.

Q.6 Can the supplier make an amendment in documents that are left pending by the recipient?

The supplier will not be able to make any amendment to pending invoices until they are rejected by the recipient.

Q.7 Who can file a NIL return?

Nil return can be filed if:

No document has been uploaded in Form GST ANX-1

No inward supplies (purchases) have been auto-populated in Form GST ANX-2

No other information needs to be reported in the main return i.e. GST RET-1/2/3.

Q.8 Under what circumstances can Form RET-1 be filed through SMS?

The Form RET-1 can be filed through SMS only in cases of a nil return.

Q.9 Certain details have been auto-populated into my Form RET-1. What is the source of these details?

Form RET-1 gets auto-populated with the details previously declared in GST ANX-1 and ANX-2.

Q.10 What is the purpose of Form ANX-1A?

Form ANX-1A can be filed to make any amendment in Form ANX-1.

Q.11 What is the due date for filing the new GST return?

The due date for filing the GST return has not been notified yet. However, it is expected that the due date of monthly return will be the 20th of the following month and the due date of quarterly return will be 25th of the month after the end of the relevant quarter.

Q.12 What is the due date for the payment of taxes?

All taxpayers will be required to make the payment of taxes on a monthly basis, even if a taxpayer opts to file returns on a quarterly basis. In the case of self-assessed liabilities, the tax payment shall be made by the 20th of the succeeding month to which liability pertains.

How Vendor Invoice or Bills effects New GST Returns Filing System?

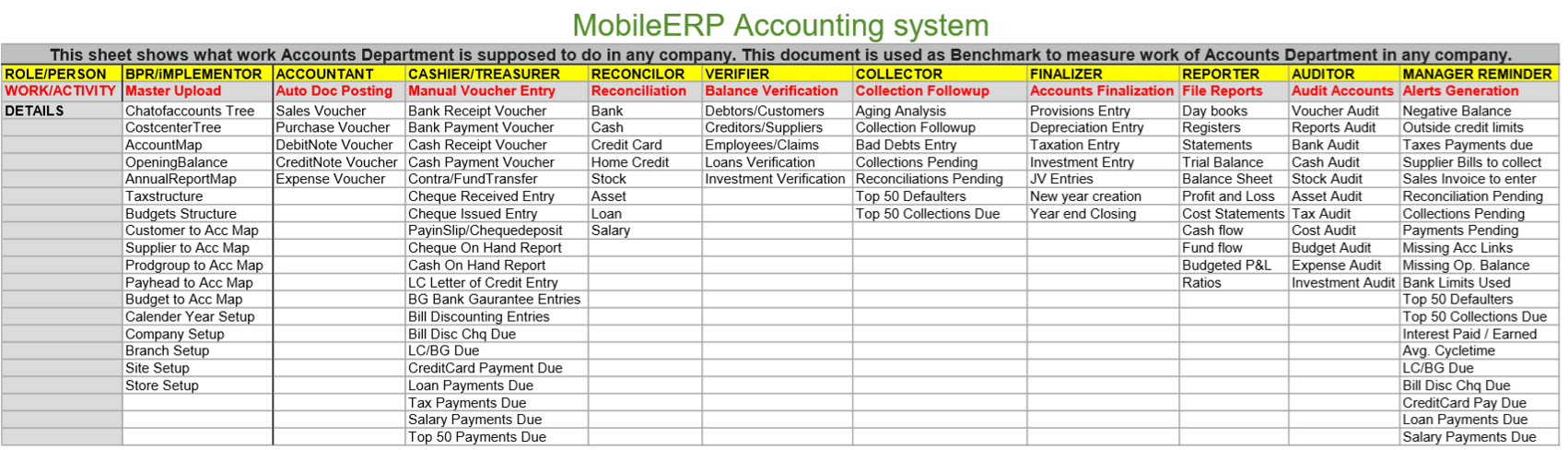

This document of vendor invoice is main input documents for GSTR2A or GST ANX-2 Report for comparison purpose.There are 2 Parts in system: GST ANX-1 & ANX-2 for Proper Reporting of Supplies

Under GST ANX 1, all outward supplies, inward supplies under reverse charge, and imports made during a particular tax period will need to be reported by the registered taxpayers.

Under GST ANX 2, details related to all the inward supplies from registered persons, supplies received from an SEZ unit/developer, and imports made by registered taxpayers will be reported.

Once a particular supplier uploads the documents related to supply in GST ANX 1, the recipient can also easily view those supply documents in his GST ANX 2. The recipient would also have the facility to take any action against these documents by either accepting them or rejecting them or put them in pending state with action to be taken at a later date.

What are various types of Sales Invoices according to GST India

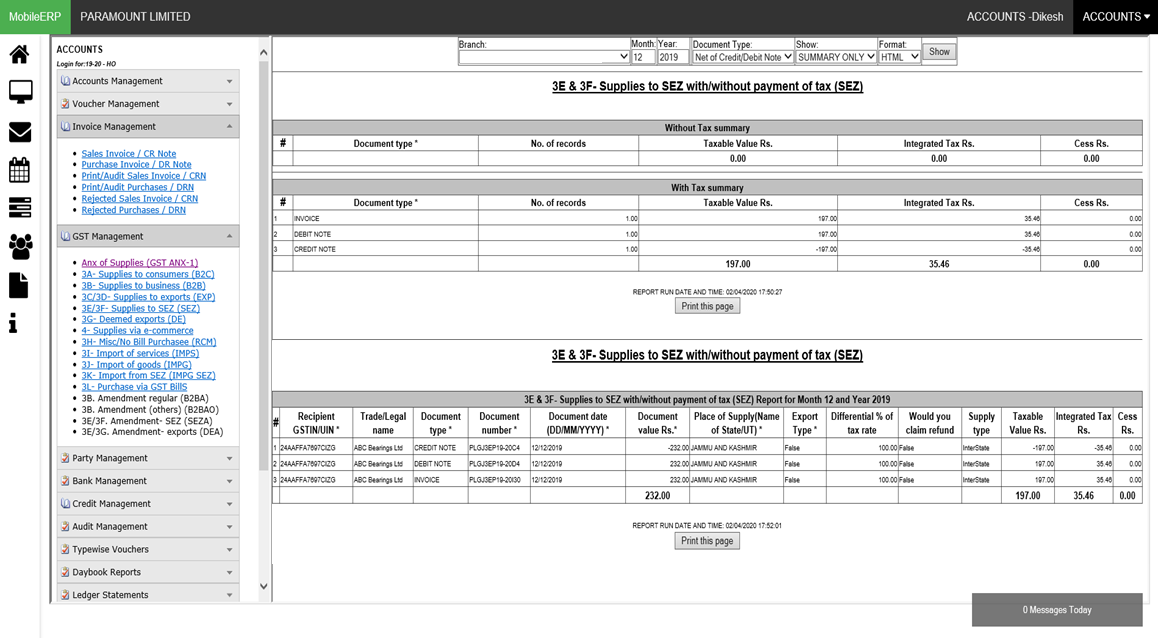

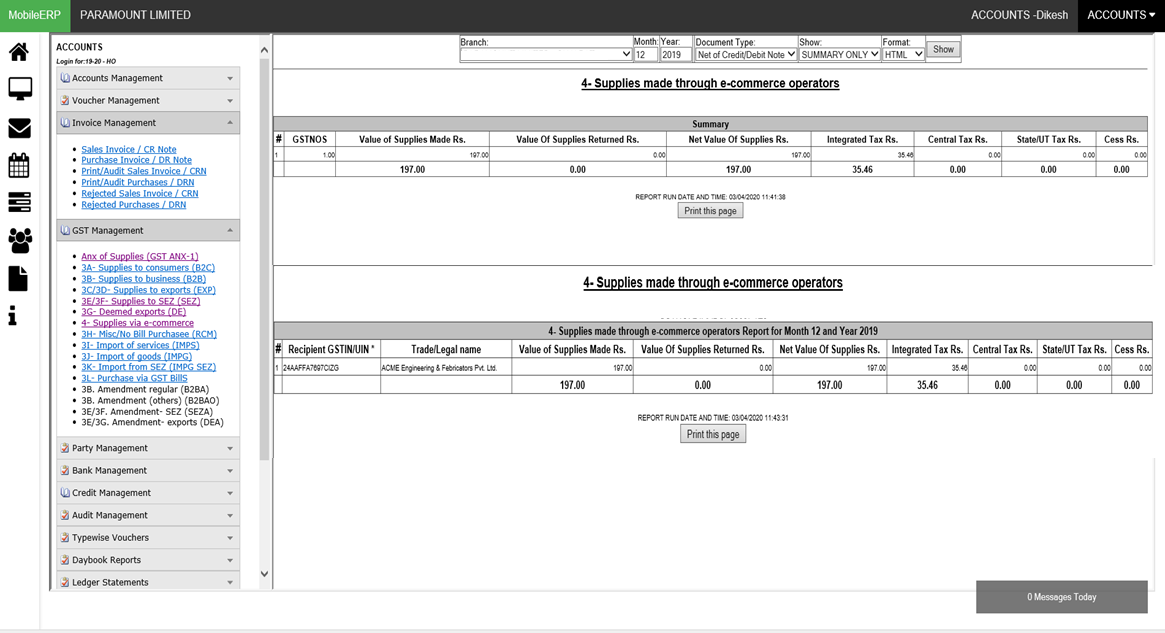

| 3A- Supplies to unregistered persons/consumers (B2C) | 3B- Supplies to registered persons (B2B) | 3C & 3D- Exports with/without payment of tax (EXP) | 3E & 3F- Supplies to SEZ with/without payment of tax (SEZ) | 3G- Deemed exports (DE) | 4- Supplies made through e-commerce operators |

|

|

|

|

|

|

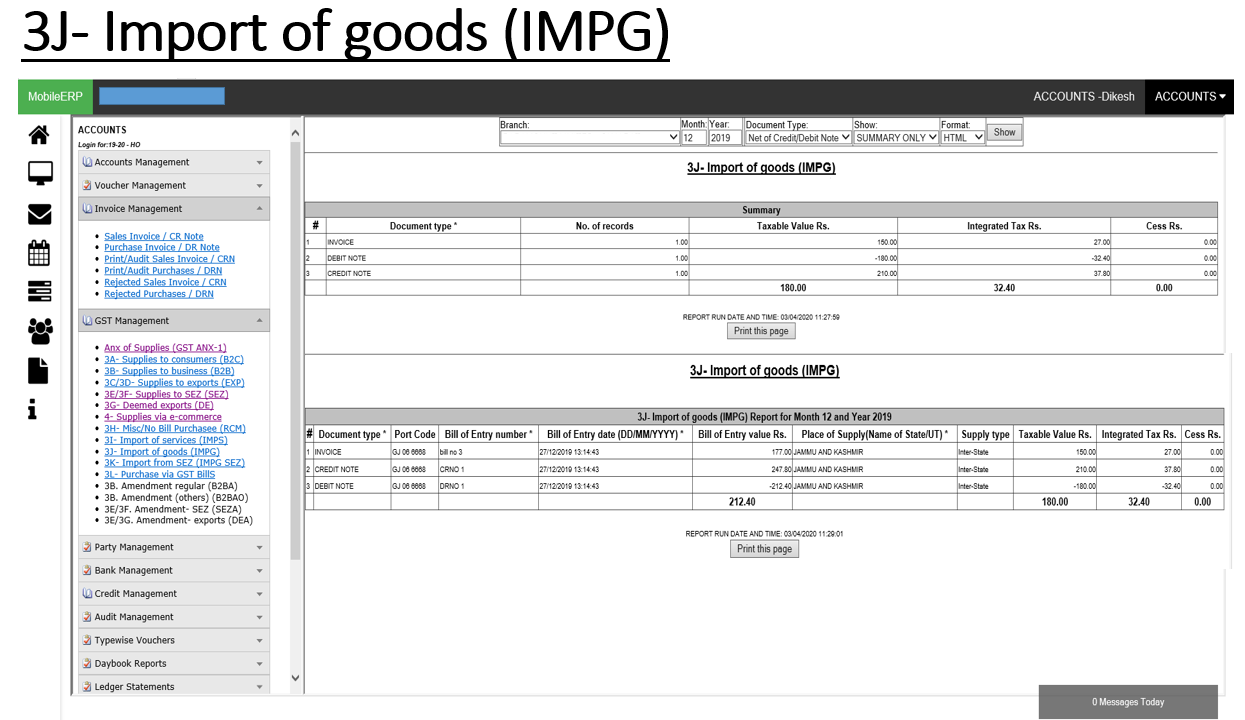

What are various types of Suppliers and Purchase Invoices according to GST India

| 3H- Inward supplies attracting reverse charge (RCM) | 3I- Import of services (IMPS) | 3J- Import of goods (IMPG) | 3K- Import of goods from SEZ units/developers (IMPG SEZ) | 3L- Missing documents (provisional credit availed) |

|

|

|

|

|

Notes:

3H-RCM: The recipient has to report invoice-wise purchases attracting reverse charge in GST ANX-1. The value and tax on RCM supplies will be auto-populated from GST ANX-1 to GST RET-1/ RET-2/RET-3. The recipient has to discharge liability and he can claim ITC based on the auto-populated figures. The recipient should hence be careful while reporting invoice-wise inward RCM supplies. Any delay can have interest implications.