Cost Allocation

Cost Center, Profit Center, Investment Center

Cost Head

Departments, Business Unit having costs

Cost Category

Facilitates 3 Dimension Reporting

Cost Center

Records Costs, Profits, Investments

Cost Allocation

Cost Heads

Cost Category

Cost Center

What is Cost Accounting?

Cost accounting is a process of recording, analyzing and reporting all of a company's costs (both variable and fixed) related to the production of a product. This is so that a company's management can make better financial decisions, introduce efficiencies and budget accurately. You will need a proper cost accountant or consultant to define your costing system.What is Cost center?

A cost centre is a company department that supervises the all the cost of the company. A cost center is a department or function within an organization that does not directly add to profit but still costs the organization money to operate. Cost centers only contribute to a company's profitability indirectly, unlike a profit center, which contributes to profitability directly through its actions. Cost center managers are fiscally responsible for the transactions charged to the center. Managers are responsible for developing the annual cost center budget of revenues and expenses for the upcoming year in conjunction with their vice president.

What is Profit center

A profit centre is a company department which is responsible for the company profits. A profit center is a section of a company treated as a separate business. ... Examples of typical profit centers are a store, a sales organization and a consulting organization whose profitability can be measured. Peter Drucker originally coined the term profit center around 1945. During master data design, we assign Profit Centers to other account assignment objects like Sales Orders, Production orders, Cost Centers, Internal orders, Projects etc… to which costs and revenues are to be posted. The main difference of a profit centre compared to a cost centre is that in a profit centre is it recording revenues – costs = profit/loss whilst a cost centre only records the costs associated with a project/task/function etc. When profits are allocated to cost centers they become profit centers.

An economic profit or loss is the difference between the revenue received from the sale of an output and the costs of all inputs used as well as any opportunity costs. In calculating economic profit, opportunity costs and explicit costs are deducted from revenues earned.

What is Cost Object?

Any type of object that is selected for cost control. Costs or revenues are either directly posted on or allocated to cost objects. Some typical cost objects are:1. Products

2. Projects

3. Departments

4. Cost centers

Management uses cost objects to quantify costs, but also to drive profitability analysis.

What is Cost Control?

Cost control is the practice of identifying and reducing business expenses to increase profits, and it starts with the budgeting process. ... As an example, a company can obtain bids from different vendors that provide the same product or service, which can lower costs. Also keeping costs below budget gives better control.What is Cost Allocation?.

Cost allocation is the process of identifying, accumulating, and assigning costs to costs objects such as departments, products, programs, or a branch.Cost allocation is a process of providing relief to shared service organization's cost centers that provide a product or service. In turn, the associated expense is assigned to internal clients' cost centers that consume the products and services as per Wikipedia.

Cost allocation is the distribution of one cost across multiple entities, business units, or cost centers. ... When cost allocations are carried out, a basis for the allocation must be established, such as the headcount in each branch or department.

WHAT IS THE PROCESS TO ALLOCATE COST?.

There are no specific methods for allocating costs. Similarly, there is no particular process for it, as well. However, the process we are detailing is one of the most popular, and many companies use it for allocating costs. Following is the process:1. DEFINE COSTS: How to classify costs?

Important classifications of costs include: By nature or traceability: Direct costs and indirect costs. Direct costs are directly attributable/traceable to cost objects, while indirect costs (not being directly attributable) are allocated or apportioned to cost objects.Before allocating the cost, a company must define the various types of costs. Generally, there are three types of costs – direct, indirect, and overhead.

a. Direct costs are those that one can easily attribute to a product or service, such as wages to factory workers or raw material for the specific product.

b. Indirect costs are ones that a company needs to incur for its operations, such as administration costs. Primarily, these are the costs that a company needs to allocate as it is difficult to attribute them to a product or service or any other cost object directly.

c. Another type of cost is an overhead cost, which is also an indirect cost. These costs are incurred for the production and selling of goods or services. Such costs do not vary based on production or sales. A company needs to pay them even if it is not producing or selling anything. Research and development costs, rent, etc. are good examples of such a cost.

2. DEFINE BASIS OF ALLOCATION

Along with the cost object, the company must also determine the basis on which it would allocate the cost. This basis could be the number of hours, area, headcount, and more. For example, if headcount is the basis of allocation for insurance cost and a company has 500 employees, then the department with 100 employees will account for 20% of the insurance cost. Experts recommend choosing a cost allocation base that is a crucial cost driver as well.A cost driver is a variable whose increase or decrease leads to an increase or decrease in the cost as well. For instance, the number of purchase orders could be a cost driver for the cost of the purchasing department.

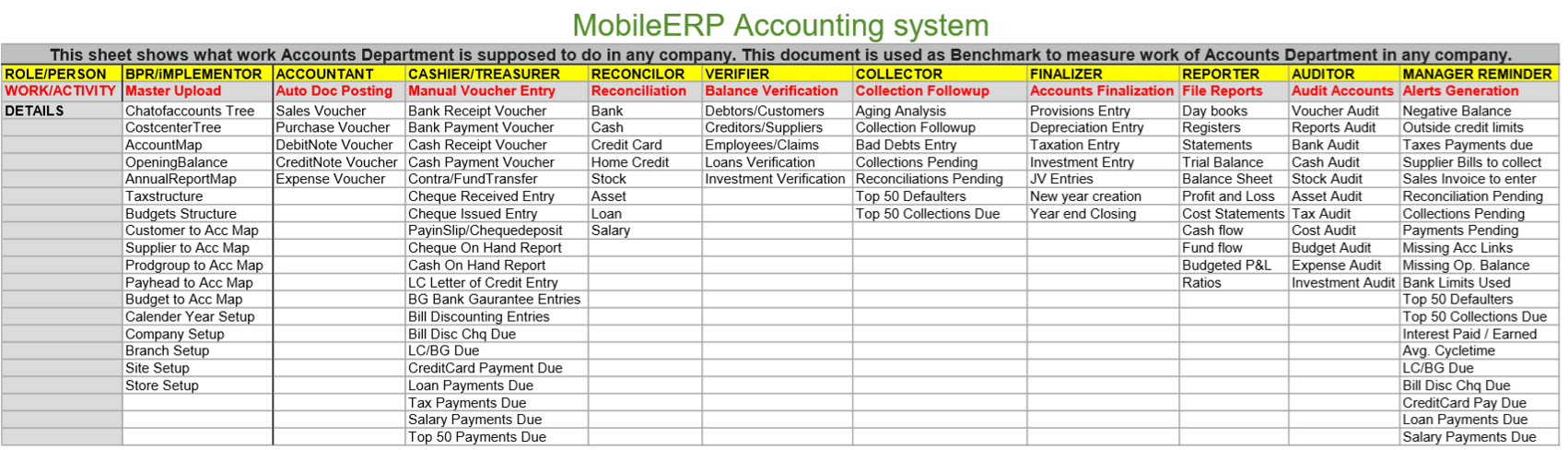

In MobileERP:

1. Define Cost Center Heads

2. Define Cost Category under Cost Center Heads

3. Define Actual Cost Center under Cost Category

What are Cost Center Heads?.

Mostly cost center heads are departments or business units or retail shops etc. Cost centre head is a cost object/collector (e.g. department, project); the entity that allows you to analyse all sorts of costs which are posted to it. Cost element can represents actual GL account and is a nature of cost (e.g. salary, rent). Primary cost elements represent P&L G/L accounts and secondary are used for internal CO processes (allocations).There are two main types of cost centres heads:

a. Production cost centres, where the products or projects are manufactured or processed. Example of this is an assembly area or project site.

b. Service cost centres, where services are provided to other cost centres. Example of this is the accoounts, personnel department or the canteen.

What is Cost Category?.

A cost category is used to define costs into a category more specific than a CBS code. The most commonly used cost category types are labor, equipment, materials, and other. These types allow you to categorize costs into groups. For example, you may want to track costs associated with labor.What is Cost Element?.

A cost element is the cost of a resource that is consumed by an activity. The concept is used in activity-based costing. For example, production supplies may be a cost element that is included in a cost pool for a production process. Used as a function to track and categorize costs. There are three types of cost elements: primary, secondary and revenue.1. Primary Cost Elements: Material Consumption, Salaries & Wages, Electricity & Water etc. This is associated with Expense Account in GL. All postings in the GL Expense Accounts are also posted in the corresponsing cost element.

2. Secondary Cost Element: Overhaed Allocation, Internal Activity Allocation, Order Settlement etc. This do not have a corresponsing GL account.Used for internal cost allocation among cost centers.

3. Revenue Cost Element: Revenue Account, Sales deduction etc. All postings in the GL Revenue account are also posted in the corresponding revenue element.

What is Cost classification?.

Cost classification groups costs according to their shared characteristics. For example, costs can be grouped by elements, traceability, and behavior.1. By elements – Materials, labor, and expenses.

2. By traceability – Direct costs and indirect costs.

a. Direct costs are assigned directly to cost objects.

b. Indirect costs aren't directly traceable to cost objects. Indirect costs are allocated to cost objects.

3. By behavior – Fixed, variable, and semi-variable.

What is Cost behavior?

Cost behavior classifies costs according to their behavior in relation to changes in key business activities. To control costs effectively, management must understand the cost behavior. There are three types of cost behavior pattern: fixed, variable, and semi-variable.a. Fixed cost - A fixed cost is a cost that doesn't vary in the short term, regardless of changes in activity level. For example, a fixed cost can be a basic operating expense of a business, such as rent, that won't be affected even if the activity level increases or decreases.

b. Variable cost - A variable cost changes according to changes in activity level. For example, a specific direct materials cost is associated with each product that is sold. The more products that are sold, the more direct materials costs there are.

c. Semi-variable cost - Semi-variable costs are partly fixed and partly variable costs. For example, an Internet access fee includes a standard monthly access fee and a broadband usage fee. The standard monthly access fee is a fixed cost, whereas the broadband usage fee is a variable cost.

What is Overhead cost element?.

Overhead costs are all of the costs on the company's income statement except for those that are directly related to manufacturing or selling a product, or providing a service. This function allows definition of cost heads under which costs can be identified.Overhead costs refer to the ongoing expenses of operating a business. They are the costs that can’t be linked directly to specific business activities. Here are some examples of overhead costs:

a. Accounting fees

b. Depreciations

c. Insurance

d. Interest

e. Legal fees

f. Taxes

g. Utilities costs

What is sunk costs?

A sunk cost refers to a cost that has already occurred and has no potential for recovery in the future. For example, your rent, marketing campaign expenses or money spent on new equipment can be considered sunk costs.